If you’ve felt sticker shock at the gas pump lately, you’re not imagining it. In California, the actual cost of fueling up is driven by more than just oil markets. It’s shaped by heavy taxes, complex regulations, and supply drawbacks — many of which the average driver doesn’t see.

That’s the message from the California Fuels + Convenience Alliance (CFCA) in their “Price Behind the Pump” overview. Below is what they’re revealing — and what you should know as a consumer (or business) operating here.

Why Gas Costs More in California

- Taxes Went Up

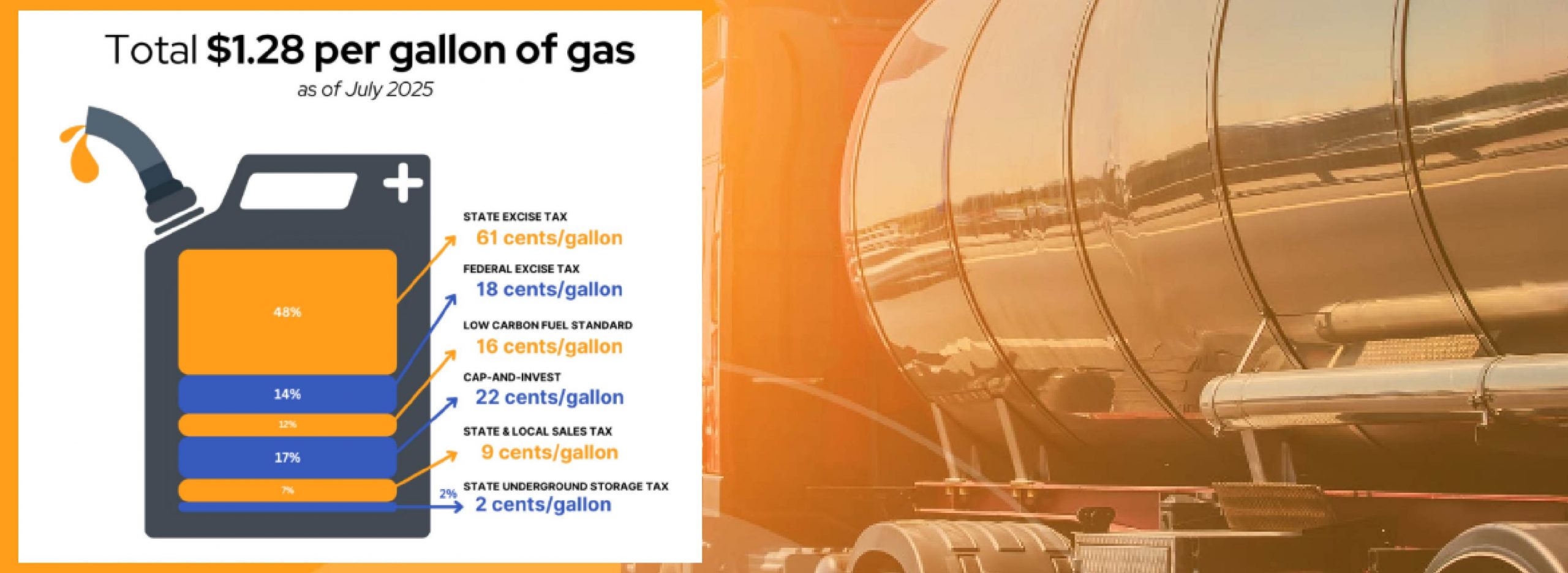

On July 1, California increased its excise tax on gasoline from 59.6 cents per gallon to 61.2 cents per gallon.

And that might just be the beginning: CFCA warns that proposed changes to the Low Carbon Fuel Standard (LCFS) could add up to 65 more cents per gallon in future years.

These added costs aren’t driven by global oil prices — they’re driven by state policy decisions.

- California’s Fuel System Is Isolated

Unlike many states tied into a broad network of pipelines, California is something of a “fuel island.”

We depend heavily on local refineries, and in recent decades, the number of active refineries has dropped from around 43 to just 9.

When supply tightens while demand holds steady, prices naturally rise.

- California-Specific Fuel Blend & Operating Costs

- The state mandates a special blend called California Reformulated Gasoline (CaRFG), designed to reduce emissions and improve air quality. That cleaner-burning fuel, however, costs more to produce.

- Higher general costs for business in California — from labor and insurance to commercial electricity and property — all contribute additional overhead that gets passed down to consumers.

What CFCA Wants You to Know (and Do)

Push for Transparency & Accountability

CFCA is sounding the alarm: a lot of these cost-driving regulatory changes are occurring without direct legislative oversight. Their concern is that unelected regulators are shaping fuel policy — and price — without public input.

They support bills like SB 2, AB 12, AB 41, AB 555, and SB 441, intended to curb LCFS expansions or hold regulatory bodies accountable. Sadly, in the most recent session, the Legislature rejected each of these measures.

CFCA encourages Californians to contact their legislators and demand more transparency and restraint.

Recognize the Role of Independent Stations

- California has over 12,000 convenience stores and nearly 10,000 gas stations.

- Almost 90% of those stations are independently owned, not major oil companies.

- Together, these businesses employ nearly 193,000 people (or close to 200,000 when accounting for associated fuel transport).

These community-based businesses are often squeezed by policies and cost burdens — making them especially vulnerable to price volatility.

What You Can Do Today

- Stay informed. Follow CFCA’s updates, especially any state regulatory changes or proposed bills tied to fuel policy.

- Reach out to your representatives. Let them know these issues affect real people, real businesses, and real expenses.

- Support local businesses. Independent stations face big challenges in balancing regulatory compliance with their bottom line.

- Watch regulatory proposals closely. Many changes get buried in technical details (like LCFS tweaks) — but the impact can be large.

We know fuel — and as your trusted fuel services partner, we’re here to help. From gasoline and diesel supply service to commercial fuel delivery, fuel cards, and more, we provide competitive pricing, smart solutions, and strategies to find savings while boosting efficiency and uptime. Our goal is simple: to keep your business moving and help it succeed.